Nonprofit Resources

Implementing the New Accounting Standard for Leases: Part Four

Step 8: Elect Transition Guidance

If your organization hasn’t adopted the new standard yet, note that it will be required for all nonprofits with fiscal years beginning after December 15, 2021 (calendar 2022 year-end; fiscal years ending in 2023).

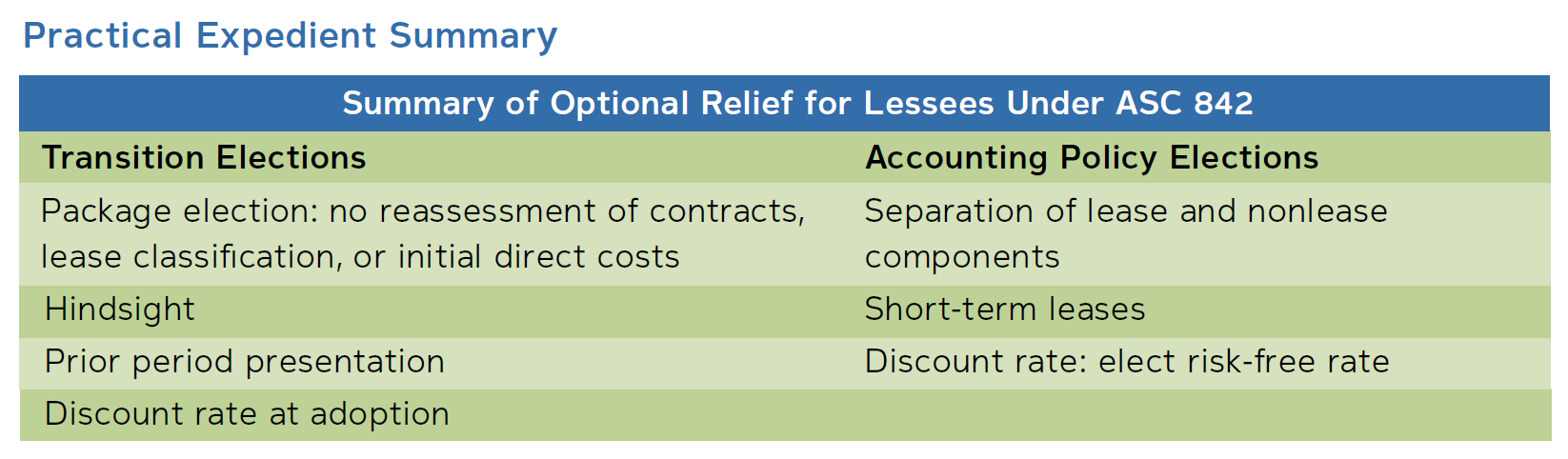

Adoption of ASC 842 requires organizations to use a modified retrospective approach, which is intended to alleviate some of the implementation challenges. There are also several practical expedients that provide relief in the adoption of the new standard as well as simplify ongoing compliance.

Prior Period Presentation

If your organization presents single-year financial statements, you will recognize and measure all of your leases as of the beginning of the reporting period by making a retrospective adjustment to record the leases.

If you present comparative financial statements, you can elect to make this adjustment as of the beginning of the earliest period presented or elect to make this adjustment as of the adoption date. In the latter scenario, the prior year would be presented under the previous guidance in ASC 840 and the current year would be presented under the new guidance in ASC 842.

Action Item #1: Determine whether to apply the new standard as of the date of adoption or as of the earliest period presented. Your organization must decide whether it is necessary to present comparative financial statements under the new lease guidance or if you can apply the transition relief and use the new guidance only in the current reporting period, which may significantly ease your adoption efforts.

Package Election

The transition guidance within ASC 842 contains several policy elections and practical expedients. The first practical expedient is referred to as the “package of three” transition relief. Organizations must either elect all three of these or none of them.

This election would be applied to leases commenced before the standard’s effective date and would allow your organization to not reassess the following:

- Whether any expired or existing contracts are or contain leases – This expedient does not cover incorrect assessments, such as failing to identify an embedded lease.

- The lease classification for any existing or expired leases – All existing leases that were classified as operating leases under the prior lease standard will be classified as operating leases under the new standard. All existing leases that were classified as capital leases under the prior standard will now be classified as finance leases under the new standard.

- Initial direct costs for any existing leases – Your organization will not need to reassess whether these costs would have qualified for capitalization under the new lease accounting standard.

Action Item #2: Decide whether your organization will adopt the “package of three” relief package. If elected, this package of practical expedients should be applied to all leases consistently. If you decide not to adopt it, you should reassess the lease classification as of the commencement date of the lease or the lease modification date.

Quick tip: Electing this transition relief will reduce the time and effort your organization will spend on implementing the new standard since you will not need to reanalyze existing leases for decisions that were properly made under the prior lease standard.

Hindsight

Your organization can elect to use hindsight when determining the lease term and assessing the impairment of right-of-use assets. You can consider the actual outcome of lease renewals, termination options, and purchase options as well as impairment of a right-of-use asset for leases commenced before the standard’s effective date.

Action Item #3: Determine whether your organization will use hindsight. If elected, hindsight should be applied to all leases consistently.

Quick tip: Since it eliminates the need to determine the impact of remeasurements and impairments in initial calculations, adopting this package of practical expedients may increase the accuracy of the information used for key decisions in the implementation of the new lease standard. However, it could be a labor-intensive process since it must be applied to all leases.

Discount Rate

The transition guidance requires organizations to determine the discount rate at the transition date (versus the inception of the lease). However, the guidance does not specify whether that rate should be based on the original term or the remaining term of the lease. Organizations appear to have a policy choice here that will impact the operating lease liability recognized at the transition date, which organizations must apply consistently to all leases.

Action Item #4: Decide whether your organization will use the original term or the remaining term of the lease in determining the applicable discount rate.

Accounting Policy Elections

In the Key Lease Decision Reference Guide and our prior articles in this series, we walked through the following accounting policy elections:

- Short-term leases – An organization can make an accounting policy election by class of underlying asset to not record leases with a term of 12 or fewer months on the statement of financial position. The lease must not include an option to purchase the underlying asset that the lessee is reasonably certain to exercise. The lease term would include renewals that the lessee is reasonably certain to exercise.

- Separation of lease and nonlease components (Step 2) – Lessees may make an accounting policy election by class of underlying asset to not separate lease components from nonlease components. If you make this accounting policy election, your organization is required to account for the nonlease components together with the related lease components as a single lease component.

- Discount rate: elect the risk-free rate (Step 4) – As a nonpublic business entity, you can make an accounting election to use a risk-free discount rate by class of underlying asset.

Action Item #5: Disclose the election of any of the transition relief and practical expedients in the notes to the financial statements.

Key Financial Statement Presentation and Disclosure Provisions

The Appendix of our Key Lease Decision Reference Guide provides a comprehensive overview of the required financial statement presentation and related disclosures. In addition, if your organization uses the CapinCrouse Lease Calculation Tool provided in our Lease Toolkit, two tabs in the workbook (the FS presentation tab and the FN Disclosures tab) provide the summarized information needed to prepare your financial statements.

Let’s look at some of the key items.

Statement of Financial Position

Organizations can report right-of-use lease assets and lease liabilities in individual line items on the statement of financial position or include them with another related class; however, you must follow these provisions:

- Operating lease right-of-use assets and finance lease right-of-use assets cannot be presented in the same line item in the statement of financial position. Similarly, operating lease liabilities and finance lease liabilities are prohibited from being presented in the same line item in the statement of financial position.

- If the above lease items are not presented separately from other assets and liabilities in the statement of financial position, the notes to the financial statements should include a disclosure of which line items are included.Quick tip: You can choose to present one class of leases in a stand-alone line item and present the other class of leases in a line item combined with other similar accounts. Make this determination based on the overall materiality of the class of leases. Typically, the lease asset and lease liability presentation should mirror each other for each class of leases.

- If your organization presents a classified statement of financial position, right-of-use assets and lease liabilities should be appropriately classified as current and noncurrent.

Statement of Activity

For finance leases, interest expense on the lease liability and amortization of the right-of-use asset should be presented in the statement of activities, consistent with the presentation of other interest expense and amortization or depreciation of similar assets.

For operating leases, lease expense is included in general operating expenditures.

Quick tip: Expenses from lease contracts are not required to be presented as separate line items in the statement of activities.

Statement of Cash Flow

For finance leases, the principal payments will be reported under cash flows from financing activities and the interest paid on the leases should also be reported. Amortization of the right-of-use asset should be included with other amortization.

For operating leases, the lease payments (expenses) are included in cash flows from operating activities.

Notes to the Financial Statements

Our Lease Calculation Tool conveniently summarizes the key quantitative disclosures for all your lease contracts. The protected formulas on the FN Disclosures tab allow the updates you make on the individual lease calculation tabs to properly flow to the summarized disclosures, including those for lease costs, weighted-average discount rate and remaining lease term, and future minimum lease payments.

The Lease Calculation Tool also provides sample narrative descriptions you can use as a template for writing individual narratives for the required qualitative disclosures.

The new lease standard is complex, but the CapinCrouse Lease Toolkit provides you with the resources you need to adopt the standard efficiently and effectively. You can access your free Lease Toolkit here.

And don’t miss our free webcast on this topic, “Untangling Leases: A Step-by-Step Guide to Implementing ASC 842,” on September 29, 2022, at 1 p.m. EDT. Learn more and register here.

Please contact us with questions or to discuss how we can assist your organization with the implementation process.

Additional Resources:

Implementing the New Accounting Standard for Leases: Part One

Implementing the New Accounting Standard for Leases: Part Two

Implementing the New Accounting Standard for Leases: Part Three

Lisa Wabby

Lisa joined CapinCrouse in July 2006 and serves as a partner. She has acquired a broad range of experience through serving a variety of clients within the nonprofit industry, including churches, colleges and universities, loan funds, foundations, international mission organizations, and voluntary health and welfare organizations. In addition to providing audit, accounting, and consulting services, Lisa is a member of the firm's Quality Control team. In this role, Lisa is an integral part of developing content for continuing professional education, developing strategies to implement new audit and accounting standards, and providing technical assistance to team members across the firm.

3 Comments

Hello ! I am writing to enquire whether under US GAAP the consolidated depreciation & amortization in the cash flow statement includes the depreciation, associated with the ‘Operating Lease Right-of-Use Assets’ in the Balance Sheet. This question came to my mind when I saw Microsoft’s latest annual cash flow statement and compared it to latest cash flow statement of Global Crossing Airlines; Global Crossing Airlines mentions ‘Amortization of operating lease right of use assets’ explicitly in its cash flow statement. Awaiting your reply .. Many thanks !

Siddharth,

The cash payments from operating leases should be reported within cash flows from operating activities. When using the indirect method for the statement of cash flows, you must provide a reconciliation from change in net assets to operating cash flows. The combined change in operating right-of-use asset (ROU asset) and lease liability generally equals the difference between the straight-line lease expense and the actual cash paid for the lease. There are two ways this can be shown utilizing the indirect method since there is no explicit guidance on this matter:

1. Since the lease standard requires a single straight-line lease expense on the statement of activities, present a single reconciliation line item such as non-cash lease expense for the combined change in ROU asset and lease liability.

2. Since ROU asset and lease liability are separate lines on the statement of financial position, present the amortization of the ROU asset as a non-cash adjustment from change in net assets and the change in lease liability due to cash payments as a change in operating assets and liabilities. For statement of activities purposes, there is no amortization of ROU asset reported; it’s only the straight-line lease expense as a single amount for operating leases.

Reply

Lisa,

Thanks for this very clear description. I haven’t spent much time looking at financials since well before the implementation of right-of-use assets and they’ve really been puzzling me. You lit a lightbulb over my head on how to reconcile cash flows with them, and wanted you to know you’ve helped me significantly, and likely many others.

Best wishes,

Randy