Nonprofit Resources

Implementing the New Accounting Standard for Leases: Part One

- Updated Key Lease Decision Reference Guide

- Updated Lease Information Gathering Form

- New Lease Calculation Tool

You can learn more about the new lease standard and download the free Lease Toolkit here.

This article is the first in a series outlining the steps in the Key Lease Decision Reference Guide in the Lease Toolkit. Our goal is to provide important action items in a quick, easy-to-read format to make the adoption of the new standard more manageable. Let’s get started!

Step 1: Determine if a Contract Contains a Lease

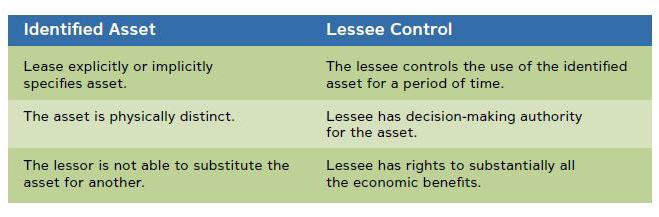

Under Topic 842, the new lease standard updates the definition of a lease to include contracts or a part of a contract that conveys the right to control the use of an identified asset for a period of time in exchange for consideration. This definition is clarified to focus on two areas :

- Whether there is a specifically identifiable asset, and

- Whether the lessee has control of the asset

Here are examples of an identified asset and lessee control:

If there is no specifically identifiable asset, or if the lessee does not have control of that asset, the contract does not contain a lease and the lease standard accounting would not apply.

Action Item #1: Create an inventory of all contracts that may contain a lease. Ensure that your inventory includes any embedded contracts — contracts that may be disguised as a service contract but that also include the lease of an asset. For example, if your organization has a service contract to receive wireless internet throughout your building, does that contract also include access to specific routers? If so, this embedded contract may include a lease under the new lease standard.

Action Item #2: Use the flowchart on page 5 of the Key Lease Decision Reference Guide to determine if each of your inventoried contracts meets the criteria to be considered a lease. For any contracts that do contain a lease, fill out Section 1 of the Lease Information Gathering Form in the Lease Toolkit.

Quick tip: In the Lease Information Gathering Form, make a copy of the tab for each contract that contains a lease, and then rename the tabs to match the underlying leases. That way, all your lease information will be in one workbook.

Step 2: Determine Which Payments are Considered Part of the Lease Calculations

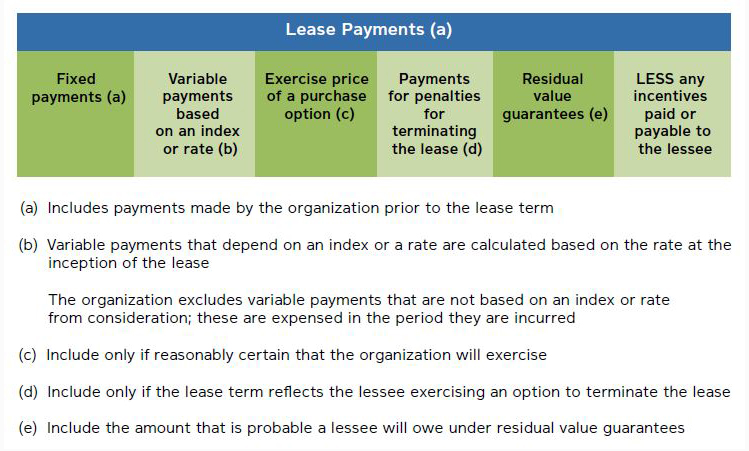

There are two key components to determining which payments are considered part of the lease calculations. You need to know:

- Which payments are included within the lease calculations; and

- The portion of the consideration paid that is attributable to the underlying lease components

Action Item #3: Use the chart above to determine the applicable payments for purposes of the lease standard calculation. Quick tip: This step aligns with Section 2 of the Lease Information Gathering Form. Continue moving down the Lease Information Gathering Form to Section 2 for each of the leases identified in Step 1 above.

Once you know what types of payments are included within the calculation, you then need to know the portion attributable to each of the underlying lease components. Components are items or activities that transfer a good or service to the lessee. Some leases have a single component while others may have multiple components. For example, a copier lease may have two components: 1) a lease for a specific asset, and 2) ongoing maintenance of the copier. Identifying these separate components is key to ensuring that the calculations are done correctly.

Refer to pages 7 – 9 of the Key Lease Decision Reference Guide for the process of identifying the different components within a lease. This should be completed for each lease in Step 1 above. Also note that an organization can make an accounting policy election (by underlying class of asset, such as equipment leases, for example) to treat all lease components as a single lease component. This means that allocating the current lease payment to the different lease components is not necessary. However, choosing this election would result in a higher right-of-use asset and liability on your books.

Action Item #4: Identify lease components. Determine if your organization wants to treat lease components separately or if you’d like to make an accounting policy election to treat both the lease and nonlease element as a single lease component. Quick tip: This step aligns with Section 2 of the Lease Information Gathering Form. If you opt to treat the components separately, you will need to determine the consideration attributable to each lease component. The Lease Information Gathering Form contains a spot to do this.

After completing these steps, you will be well along in the process of adopting the new lease standard. In our upcoming article, we’ll walk through the next two steps in adoption. In the meantime, please contact us with questions or to discuss how we can help your organization with the implementation process.

Additional Resources:

Implementing the New Accounting Standard for Leases: Part Two

Implementing the New Accounting Standard for Leases: Part Three

Tammara Williamson

Tammara joined CapinCrouse in October 2010. As a partner in the Colorado Springs office serving the firm's West region, she provides various assurance and advisory services to numerous types of nonprofit organizations, including churches, camping ministries, mission-sending organizations, and colleges and universities. Tammara also serves as Director of Training within CapinCrouse.