Nonprofit Resources

Implementing the New Accounting Standard for Leases: Part Two

These articles provide important action items in a quick, easy-to-read format to make the adoption of the new standard more manageable. Part One, which focuses on Steps 1 and 2, is available here.

Step 3: Determine the Lease Term

Once you’ve worked through the two steps outlined in Part One, determining if the contract contains a lease and which payments are considered part of the lease calculations, the third step is to determine which periods of the lease should be included in the lease standard calculation.

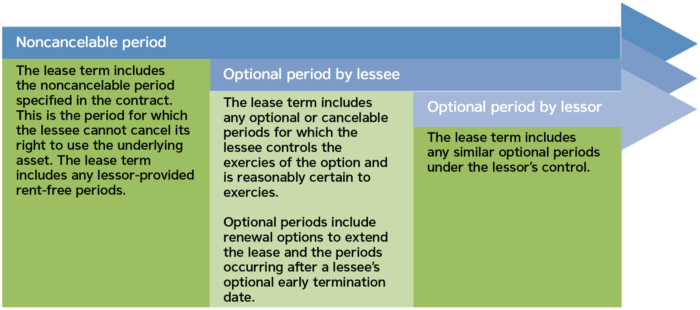

The lease term begins at the commencement date and always includes the noncancelable period of the contract, including any rent-free periods. The noncancelable period is the period during which the contract is enforceable and therefore both parties have rights and obligations to continue the lease. A lease is no longer enforceable when both parties have the unilateral right to terminate the lease without permission from the other party with no more than an insignificant penalty.

Action Item #1: Determine the noncancelable period of the lease, including rent-free periods. Sometimes a contract includes an option that only a lessee has the right to terminate the lease. In this situation, include any periods for which your organization is reasonably certain not to exercise that option in the lease term.

If the contract includes an option for you to extend the term of the lease, include all periods your organization is reasonably certain to extend in the lease term.

Reasonably certain is a high threshold of probability that must be met to include the optional lease periods above in the lease term for the purpose of determining the lease standard calculation. Your organization should consider the relevant factors that create an economic incentive for you to exercise or not exercise an option. These include contract-based, asset-based, entity-based, and market-based factors.

Some of the factors to consider include the following:

- Is the price of a lease renewal option at a fixed rate, or is it a discounted rate that creates an economic incentive for you to renew?

- Are there leasehold improvements that would make extending the lease term beneficial to you?

- Is the leased asset significant to your organization’s operations? If so, is there a readily available replacement asset?

- Do you have a sublease term that extends beyond the noncancelable period of the lease?

It’s important to note that management’s intent to renew a lease or its history of renewing similar arrangements does not directly correlate to conclude that the organization is reasonably certain to exercise an option. There still must be a compelling economic reason to renew.

Action Item #2: Determine which optional periods you as the lessee control to include in the lease term, based on the relevant economic factors. Sometimes a contract includes an option that only the lessor has the right to terminate a lease; the lessee’s lease term includes the period covered by this option. The likelihood of the lessor exercising the termination option is not considered in evaluating the potential impact on the lease term.

If the contract includes periods the lessor has the option to extend, you as the lessee must include these periods in the lease term.

Action Item #3: Determine if there are any periods for which the lessor controls the right to extend or terminate the lease. The lease term should assume that the lease will not be terminated and that the lessor will renew the lease.

Action Item #4: Use the prior action items in this step and the chart above to determine the initial lease term for the purpose of the lease standard calculation. Quick tip: This step aligns with Section 3 of the Lease Information Gathering Form in the CapinCrouse Lease Toolkit. Continue moving down the Lease Information Gathering Form to Section 3 for each of the leases identified in Step 1 from Part One in our series.

Step 4: Determine the Discount Rate

Determining an accurate discount rate is a critical component of the lease liability calculation. The lease liability is calculated based on the present value of the remaining lease payments, which is determined from the discount rate established at the commencement of the lease. The higher the discount rate, the lower the lease liability will be.

You must use the rate implicit in the lease when you are able to readily determine the rate. An implicit rate is considered readily determinable when all material inputs are themselves readily determinable by the lessee.

Action Item #5: Determine if the lease has an implicit rate. If so, it must be the rate used in the lease calculations. Quick tip: The implicit rate will be almost impossible to determine if it is not explicitly stated in the contract. Move to Action Item #7 for any lease that has an implicit rate.

If you are not able to readily determine the rate implicit in the lease, you must use your incremental borrowing rate unless you elect to use the risk-free discount rate. Make this election by class of underlying asset.

Your incremental borrowing rate is the rate of interest that a lessee would have to pay on a collateralized loan with similar terms in a similar economic environment. As a result, the incremental borrowing rate will not always be equivalent to the borrowing rate on your loans.

The risk-free rate should be determined using a period comparable with that of the lease term. Organizations typically will use the U.S Treasury yield at the date of lease commencement or upon implementation of the new standard for the risk-free rate. You should select the term closest to the lease.

Action Item #6: Determine which class of underlying assets, if any, you will use the risk-free rate for and which you will use a relevant incremental borrowing rate for. Quick tip: The risk-free rate election typically results in a higher recorded lease liability. Weigh the administrative benefits of this election against the higher financial liabilities and consider which classes of assets to apply this election to. Factors to consider include the amount and frequency of the lease payments.

Once you decide whether to use the incremental borrowing rate or the risk-free rate, determine the applicable rate to be used based on the relevant criteria outlined above.

Action Item #7: Using the rate determined in Action Item #5 or #6, input the rate for the lease agreement for the purpose of the lease standard calculation. Quick tip: This step aligns with Section 4 of the Lease Information Gathering Form. Continue moving down the Lease Information Gathering Form to Section 4 for each of the leases identified in Part One.

Step 5: Determine the Classification of a Lease

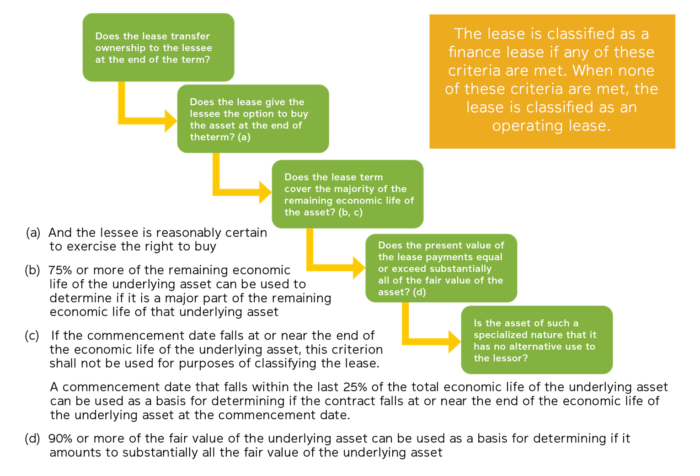

Under the new standard, lease classification no longer determines if a lease will be recorded as an asset and liability on the statement of financial position, since all leases are recorded. The classification criteria are very similar to the previous lease classification criteria. Essentially an operating lease permits the use of an asset without transferring the ownership right of that asset for a major part of the asset’s life.

Lease classification is determined at the commencement date and affects the amount and timing of lease expense. Operating leases require lease expenses to be recognized on a straight-line basis over the lease term. Financing leases recognize interest expense and amortization expense, which generally results in higher expenses at the beginning of the lease that decrease over the lease term.

The following flowchart is used to determine classification:

Action Item #8: Use the chart above to determine the lease calculation for the purpose of the lease standard calculation and related financial statement disclosures. Quick tip: This step aligns with Section 5 of the Lease Information Gathering Form. Continue moving down the Lease Information Gathering Form to Section 5 for each of the leases identified in Part One.

After completing Steps 1 and 2, which are outlined in Part One, and the steps provided here, you will have successfully navigated through the key decisions that affect the accounting for each of your lease contracts. In our next article, we’ll walk through the calculations for recognition and initial measurement of your organization’s lease contracts as well as the calculations for ongoing measurement.

In the meantime, please contact us with questions or to discuss how we can help your organization with the implementation process.

Additional Resources:

Implementing the New Accounting Standard for Leases: Part One

Implementing the New Accounting Standard for Leases: Part Three

Lisa Wabby

Lisa joined CapinCrouse in July 2006 and serves as a partner. She has acquired a broad range of experience through serving a variety of clients within the nonprofit industry, including churches, colleges and universities, loan funds, foundations, international mission organizations, and voluntary health and welfare organizations. In addition to providing audit, accounting, and consulting services, Lisa is a member of the firm's Quality Control team. In this role, Lisa is an integral part of developing content for continuing professional education, developing strategies to implement new audit and accounting standards, and providing technical assistance to team members across the firm.

1 Comment

Lisa:

Is it possible to get an unprotected version of the CapinCrouse-Lease-Calculation-Tool? I wanted to add a row to account for a lease incentive (reimb of moving costs) that would reduce the total liability payments and lease liability