Nonprofit Resources

Implementing the New Gifts-in-Kind Presentation and Disclosure Standards

In September 2020, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2020-07, Not-For-Profit Entities (Topic 958): Presentation And Disclosures By Not-For-Profit Entities For Contributed Nonfinancial Assets. ASU 2020-07 is effective for fiscal years beginning after June 15, 2021 (or, for organizations that do interim reporting, interim periods beginning the following year).

Examples of contributed nonfinancial assets include:

- Food

- Used clothing and household items

- Supplies

- Pharmaceuticals

- Medical equipment

- Intangibles

- Contributed use of long-lived assets

- Contributed services

Background and Objective of the New Standards

Unlike the process for determining the fair value of cash and marketable securities, which is typically straightforward, the valuation process for most contributed nonfinancial assets is more challenging.

The objective of ASU 2020-07 is to increase transparency about gifts-in-kind, including how they are valued and utilized, through enhanced presentation and disclosure. This is meant to address concerns from some stakeholders about nonprofits inflating the fair value measurements of gifts-in-kind, which would thereby increase a nonprofit’s revenue and program expenses and make it appear larger and more efficient in its use of resources than a smaller nonprofit or one that had lower values for contributed gifts-in-kind.

The New Gifts-in-Kind Presentation Requirements

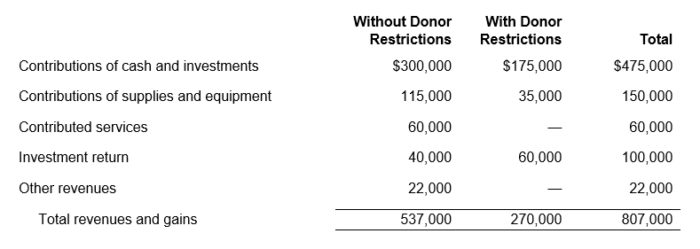

Under ASU 2020-07, nonprofits are required to show in-kind revenue as a separate line item on the statement of activities, apart from contributions of cash and other financial assets.

Here is an example:

The New Gifts-in-Kind Disclosure Requirements

The new standards require nonprofit entities to disclose the total value recognized for each category of gifts-in-kind received in the notes to the financial statements. The total value should agree to the total value of gifts-in-kind recognized in the statement of activities.

The following must be disclosed for each category:

- Qualitative information about whether the gift-in-kind was monetized (i.e., sold) or used during the reporting period. If it was used, also disclose a description of the programs or other activities in which the assets were used. A best practice is to use the same program or activity names in the disclosure that are used in the expense section of the statement of activities.

- Your organization’s policy, if applicable, regarding monetizing rather than using gifts-in-kind.

- A description of any donor-imposed restrictions associated with the gift-in-kind.

- A description of the valuation techniques and inputs used to arrive at the fair value measurement.

- The principal market (or most advantageous market) used to arrive at a fair value measurement if it is a market in which the organization is prohibited by a donor-imposed restriction from selling or using the contributed nonfinancial assets.

For contributed services, the disclosures above are in addition to the disclosures currently required for contributed services.

What Hasn’t Changed

Note that the new standards do not change the existing standards for valuing gifts-in-kind.

Contributions of gifts-in-kind must be reported at fair value when received, in accordance with FASB ASC 958-605, Not-for-Profit Entities—Revenue Recognition. As noted above, the new presentation and disclosure standards in ASU 2020-07 require a nonprofit to disclose the valuation techniques and inputs used to arrive at the fair value measure used when recognizing the contribution revenue.

It is important to understand and use the steps for determining fair value for the assets your organization receives. Here are some resources to help:

- FASB ASC 820, Fair Value Measurement, explains how to measure fair value for financial statement purposes

- The steps in determining the fair value of gifts-in-kind are illustrated in this Gifts-in-kind flowchart from the American Institute of Certified Public Accountants (AICPA)

- The AICPA Audit and Accounting Guide Not-for-Profit Entities discusses “Fair Value Measurement of Gifts-in-Kind” in paragraphs 5.128 through 5.144

Next Steps

It’s important to begin planning for and implementing the new presentation and disclosure standards now. Please contact us if you have any questions or we can help you with this process.

Additional resources:

Gifts-in-Kind: Reporting Contributions of Nonfinancial Assets – first published in the 2018 AICPA Not-for-Profit Entities Industry Developments – Audit Risk Alert

Challenges in Auditing GIK – first published in the 2018 AICPA Not-for-Profit Entities Industry Developments – Audit Risk Alert

“FASB’s New Standards for Presentation and Disclosure of Gifts-in-Kind” – available in the 2021 AICPA Not-for-Profit Entities Industry Developments – Audit Risk Alert

Frank Jakosz

Frank serves as Partner and Quality Assurance Director at CapinCrouse and has more than 50 years of public accounting and nonprofit expertise. He has a deep understanding of nonprofit organizational best practice financial functions and operations, and his expertise includes financial reporting and analysis, investments, internal controls, endowments, and grants management. As the firm’s Quality Assurance Director, Frank provides oversight of all functions of internal quality assurance, including continuing professional education, systems and processes, and monitoring and implementing new technical standards. Frank is a Chartered Global Management Accountant (CGMA) and holds an AICPA Not-for-Profit Certificate.