Nonprofit Resources

Challenges in Auditing* GIK

Assessing an NFP’s policies and procedures related to valuing material GIK transactions is an important part of an NFP audit*. Because there is no single source of pricing that is appropriate for valuing GIK donations, it falls on the NFP to arrive at an appropriate estimate of fair value. Developing an accurate estimate could involve significant time, effort, and cost, and the NFP should take that into account when deciding to accept a GIK donation. The due diligence process, level of effort by the NFP, and the facts and circumstances for each transaction vary and make auditing GIK contributions received especially challenging. Some key considerations when assessing these estimates are discussed in the following sections.

What Does a “Fair Value Measurement” Mean When It Comes to GIK Contributions?

Fair value is defined as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date” (FASB ASC Glossary). However, an NFP receives these assets as a contribution, not as a market participant. Thus, the NFP has a hypothetical consideration: Which market would it use if it were to sell the goods? Would the goods be sold in an exit market as a retailer, wholesaler, or manufacturer, or would they be sold in some other market? What if the NFP does not have access to sell the goods in any market?

Certain GIK may not have a readily determinable marketplace, but typically, they have a base utility that is marketable to someone. NFPs should consider that base utility when determining market values for GIK.

Consideration of Legal Restrictions

Legal restrictions fall into one of two buckets — those that affect the entity or those that affect the asset. Legal restrictions that affect only the NFP do not affect the underlying asset’s fair value because a hypothetical buyer would not consider the restrictions in a purchase decision because that buyer’s use of the asset would not be affected by the restriction imposed on the entity. On the other hand, legal restrictions that could limit a buyer’s use of the GIK may affect the assets’ fair value. For example, a land conservation easement that limits the use of a piece of land would be considered by a hypothetical buyer and may affect the land’s value. An NFP may never actually sell the GIK, but a hypothetical sale should be considered in determining fair value. An NFP needs to identify any legal restrictions on the GIK and determine if they would affect a hypothetical buyer’s use and, thus, the fair value measure.

Valuation

The following four areas addressed in FASB ASC 820 are particularly challenging when it comes to determining fair value of GIK:

- Market participants. NFPs often distribute GIK free of charge or for a nominal fee to beneficiaries who can use the goods but generally do not have access to them. These beneficiaries are not market participants. In addition, nominal fees charged are not prices for the GIK’s highest and best use; they are prices that reflect the NFP’s mission objectives. Market participants are entities who would transact for the goods and are able to buy the product at its market price. Because of the nature of GIK, a hypothetical market participant scenario may need to be developed to identify potential market participants. These may include other NFPs, governmental agencies, or other entities (including for-profit entities), depending on the goods involved.

- The principal (or most advantageous) market. Fair value should be determined using inputs from the principal market (defined as the market with the greatest volume and level of activity for the asset), or if there is no principal market, from the most advantageous market (defined as the market that maximizes the amount that would be received to sell the asset). Certain GIK, such as pharmaceuticals, clothing, toys, and so on, are regularly obtained subject to entity restrictions prohibiting the NFPs from selling the assets. In those cases, there is no market in which the reporting entity could sell the asset. FASB ASC 820-10-35-6B states that although a reporting entity must be able to access the market, it does not need to be able to sell the particular asset or transfer the particular liability on the measurement date to be able to measure fair value on the basis of the price in that market. Further, the Financial Reporting Executive Committee (FinREC) believes that limitations imposed by IRC Section 170(e)(3) (which provides a larger deduction to the donor if the NFP agrees to use the GIK, rather than sell them), as well as donor-imposed restrictions limiting the geographic area in which GIK may be distributed, are restrictions specific to the entity. Because those restrictions are not a characteristic of the asset that would transfer to market participants, such restrictions would not be considered in pricing the asset.

- Inputs to valuation techniques. Once the proper marketplace is identified, it is necessary to identify a source for exit prices in that market. Locating sources is not always easy or inexpensive. Accounting standards provide only broad, general guidance, and many NFPs struggle to find useful guidelines to help determine the value of donated assets. Sometimes, inputs can be found, but the prices may need to be adjusted for differences between the source item and the GIK or for differences between the source price (which could be a list price) and an exit price. The AICPA Audit and Accounting Guide Not-for-Profit Entities provides the following examples.If GIK are received in wholesale quantity but only retail values are readily available to use as inputs to fair value, then a wholesale discount generally would be applied. Similarly, if the GIK have earlier expiration dates than those of products typically sold in the marketplace or if technological advances have made the GIK less desirable than similar items in the marketplace, a discount should be applied. Whenever GIK differ from the item observed in the marketplace transaction, the NFP should consider whether an adjustment is needed to determine fair value. For some types of GIK, a range of valuation inputs are available, which can result in dramatically different valuations, especially if observed inputs have not been properly adjusted. Small and mid-sized NFPs may not have the resources to access that type of market data. Even NFPs with the resources to purchase the data have discovered that identifying the relevant variables and making the necessary adjustments can be very complicated. Management should consider the potential materiality of the GIK and determine how best to use its limited resources to find inputs.

- Use of hypothetical markets. Due to the constraints outlined in the three preceding items, the markets and transactions used for valuation are often hypothetical; yet, this remains the most likely source for determining fair value of certain GIK. All entities that could have access to the hypothetical market should be considered, including for-profit entities, and the value determined in such a hypothetical market would be derived from the hypothetical market participant’s perspective as opposed to the reporting entity’s perspective.

In other words, if the NFP does not have the ability to sell in any market, FASB ASC 820-10-35-6C states

Therefore, the NFP should construct an assumed transaction in a hypothetical or “most likely” market based on its own assumptions about what participants in that market would consider in transacting a sale of the asset. It is reasonable to conclude that activity in inaccessible known markets may be considered in developing the inputs that would be used in a hypothetical market if the reporting entity does not have access to any known or observable markets.

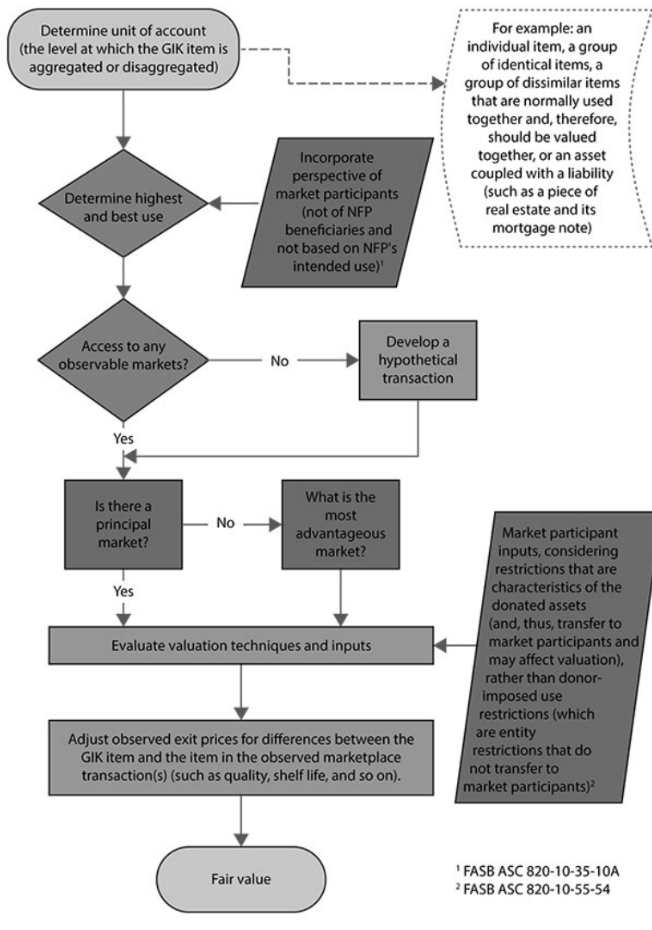

Flowchart for GIK of Nonfinancial Assets

The following is a flowchart describing considerations for the valuation of GIK of nonfinancial assets.

For GIK received, NFPs can look at the characteristics of the GIK, as well as assumed transactions, to determine appropriate fair values. Though the valuation and contribution considerations are complex, an NFP would be well-served to develop and document a consistent, reasonable process to assess and record the fair value of GIK in accordance with U.S. GAAP. Significant judgment may be involved with GIK. Management’s documentation of its assessments and all the GAAP considerations is key.

Readers can obtain additional fair value information from the following sources:

- FASB ASC 820

- AICPA Audit and Accounting Guide Not-for-Profit Entities, chapter 5, paragraphs .130—. 146, “Fair Value Measurement of Gifts-in-Kind”

Auditors can obtain information on auditing fair value accounting estimates from AU-C section 540, Auditing Accounting Estimates, Including Fair Value Accounting Estimates, and Related Disclosures.

Standards developed and published by Accord Network (formerly AERDO) could assist NFPs and their auditors. These standards offer best practices and additional guidance for NFPs in applying GAAP and IRS rules for GIK acceptance, accounting, and reporting. The standards can be found at here. Note that although they have been developed with every effort to follow GAAP, Accord’s GIK standards are nonauthoritative under FASB ASC.

This document originally appeared in the AICPA’s Not-for-Profit Entities Industry Developments—2018

©2018 AICPA. All rights reserved. Used by permission.

Additional Resource:

Gifts-in-Kind: Reporting Contributions of Nonfinancial Assets