Nonprofit Resources

Implementing the New Accounting Standard for Leases: Part Three

Is your organization ready for the new accounting standard for leases? ASC 842 introduces new definitions, classifications, and disclosures, among other changes. This article is the third in a series designed to walk you through the steps in the Key Lease Decision Reference Guide available in the free CapinCrouse Lease Toolkit.

These articles provide important action items in a quick, easy-to-read format to make the adoption of the new standard more manageable. Part One and Part Two cover Steps 1 through 5. Now let’s look at Steps 6 and 7, which will help you determine the calculations for recognition and initial measurement and determine the ongoing (or subsequent) measurement.

Step 6: Determine the Calculations for Recognition and Initial Measurement

If you’ve been following the steps in the first two articles in this series, at this point you will have determined:

- If the contract contains a lease

- Which payments are considered part of the lease standard calculation

- The lease term

- The discount rate

- The classification of the lease

Once you have gathered this information, you’re ready to make the initial calculation.

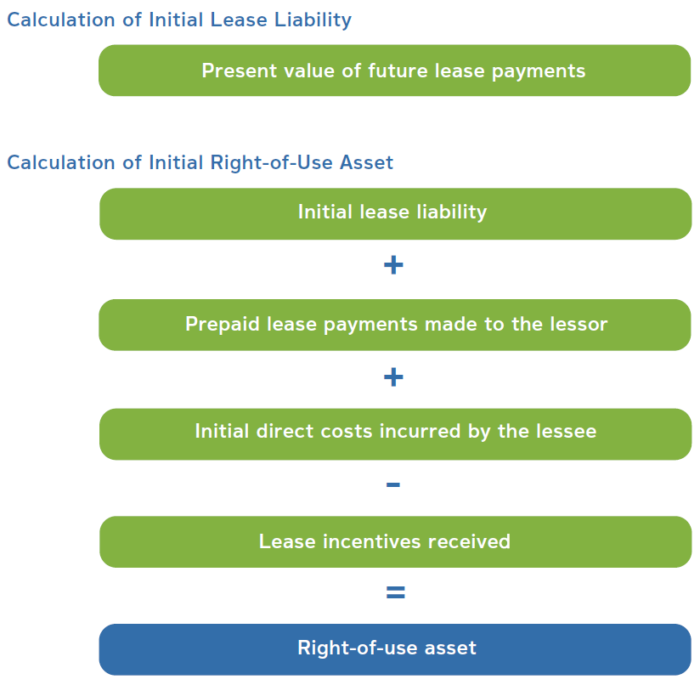

Action Item #1: Calculate the initial lease liability and right-of-use asset. A lessee must recognize a lease liability and right-of-use asset for all leases. Recognition and measurement of a lease occur at the commencement date. The lease commencement date is the date the lessor makes the asset available for use by the lessee.

The lease asset will be equal to the lease liability at the start of the lease, adjusted for any prepaid rent, initial direct costs, and lease incentives. The initial right-of-use asset and lease liability will be the same for operating leases and finance leases.

As a reminder, lease payments are reduced by any future fixed incentives that are payable to you as the lessee. Therefore, if the contract includes the right to receive a payment in the future, enter the lease incentive as a negative payment amount at the applicable date in the payment column of the Lease Calculation Tool, which is available as part of our free CapinCrouse Lease Toolkit.

Quick tip: Section 6 of the Lease Information Gathering Form in the CapinCrouse Lease Toolkit summarizes the information needed for the initial measurement calculation. If you’ve taken the action steps in Part One and Part Two of this article series, you will have completed this section.

Quick tip: Open the CapinCrouse Lease Calculation Tool. Depending on whether the lease is an Operating Lease or Finance Lease, complete Quadrant 1 Column D of the respective tab using the information found in Section 6 of the Lease Information Gathering Form. The initial measurement of the right-of-asset and liability will auto-populate in Row 23 within Quadrant 2.

Note the following:

- For the initial measurement to calculate correctly, you will need to update the payment dates in Quadrant 2 Column B to reflect the details shown in Quadrant 1. The Lease Calculation Tool has examples so you can easily see how the tool works.

- Do not delete any of the tabs in the workbook. If there are tabs you don’t need, simply remove the information in Quadrant 1 Column D and then hide the unused tabs.

- The Lease Calculation Tool has a number of protected cells that cannot be modified. These protected cells are the key cells needed for accurate calculations.

Step 7: Determine the Ongoing (or Subsequent) Measurement

Once you’ve completed the initial measurement of the right-of-use asset and liability, you must determine the necessary entries to accurately capture the subsequent measurement of the lease.

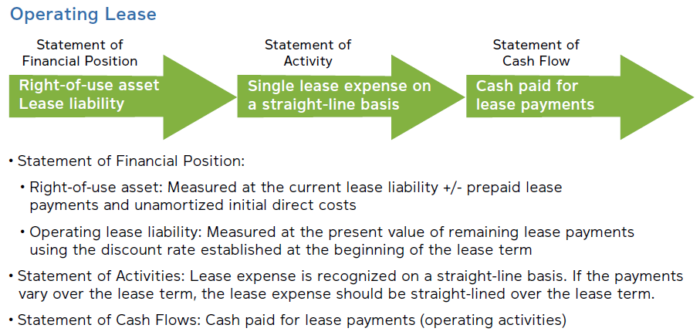

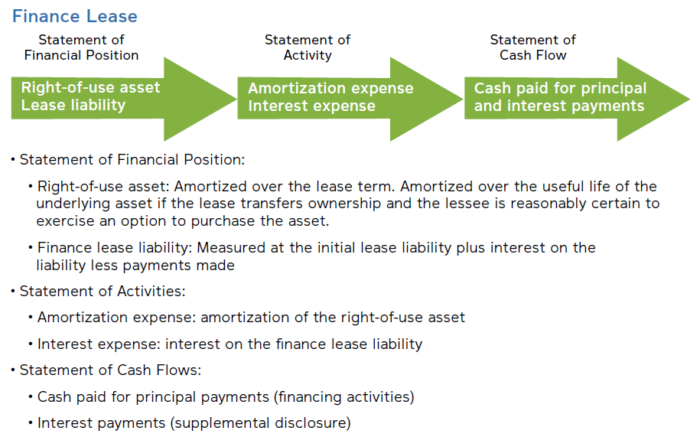

Finance leases will result in greater expense in the early years of the lease term and a lesser expense in the later years. Conversely, operating leases will result in a single straight-line lease expense throughout the lease term, unless another pattern is more representative of the lessee’s anticipated consumption of the asset’s future economic benefits.

Action Item #2: Calculate the ongoing (or subsequent) measurement of the lease. See pages 14 – 15 of the Key Lease Decision Reference Guide for examples of commencement date, year 1, and year 2 entries for operating and finance leases.

Quick tip: Once Quadrant 2 Column B of the Lease Calculation Tool is updated for the accurate payment dates as shown in the examples mentioned above, the tool will calculate the ending balances for the right-of-use asset and liability at each payment date. It will also calculate the liability reduction, right-of-use asset reduction, and lease expense (for operating leases) or liability reduction, interest expense, and amortization expense (for financing leases) in Quadrant 3. For these calculations to be correct, you will need to manually update the links in Columns O and P to correspond to your fiscal year.

In subsequent years, you won’t need to create a new workbook for each lease. Just update the years and links in Quadrant 3 to the current year for accurate calculations.

After completing these steps, you will have successfully navigated through the key decisions that affect the accounting for each of your lease contracts and completed the initial and subsequent measurements based on those decisions and the underlying contracts.

In our upcoming article, we’ll walk you through the transition guidance for adopting the standard. In the meantime, please do not hesitate to contact us with questions or to discuss how we can assist your organization with the implementation process.

Additional Resources:

CapinCrouse Lease Toolkit

Implementing the New Accounting Standard for Leases: Part One

Implementing the New Accounting Standard for Leases: Part Two

Tammara Williamson

Tammara joined CapinCrouse in October 2010. As a partner in the Colorado Springs office serving the firm's West region, she provides various assurance* and advisory services to numerous types of nonprofit organizations, including churches, camping ministries, mission-sending organizations, and colleges and universities. Tammara also serves as Director of Training within CapinCrouse.