Nonprofit Resources

Not-for-Profit Financial Reporting 3.0: New FASB Exposure Draft

First, a little background. Until the FASB issued guidance for not-for-profit organizations in June 1993 (Statements No. 116, Contributions Received and Made and No. 117, Financial Statements), there were different accounting practices for different types of not-for-profit entities. These differing practices had been set forth as industry audit guides issued by the American Institute of Certified Public Accountants (AICPA) in the 1970s. The guides covered health care organizations, voluntary health and welfare organizations, colleges and universities, and other nonprofit entities.

During the 1970s the FASB also initiated studies to understand financial reporting for non-business organizations. This culminated in Concepts Statement No. 4, Objectives of Financial Reporting by Nonbusiness Organizations, issued in December 1980. Statements 116 and 117 were issued 13 years later after more study and deliberation, thereby creating the first comprehensive accounting standards for all not-for-profit entities and a new financial statement framework. The statements addressed a diverse range of practices, including areas such as pledges, investments and other assets, reporting donated services, and treatment of donor-restricted contributions.

This model has been rigid in the presentation of resources inflows and outflows on the statement of activities between three classes of net assets — unrestricted, temporarily restricted (time and purpose), and permanently restricted (in perpetuity). Beyond that there has been a significant amount of flexibility, even though most not-for-profit organizations have very similar statements with the columnar option.

It has now been more than 20 years since those standards were issued — just enough time to get really comfortable with them and have a hard time changing. So why go to version 3.0?

FASB Not-for-Profit Advisory Committee and Proposed Changes

The FASB formed a not-for-profit advisory committee (NAC) in 2010 to provide input from a broad group of financial statement users, preparers, and others, such as oversight groups. While the underlying accounting principles were generally considered to be relevant, there has been a sense that improvements could be made to the reporting model. Many felt that the statements could be more meaningful and relevant to understanding an organization’s business operations, liquidity, and use of resources. There was also a feeling that the statements could do a better job of “telling the story” of the organization’s finances by including more pertinent information, rather than disclosures that do not contribute to understanding.

The FASB initially approved two projects: a standards-setting project to consider the financial statements, and a research project to consider providing guidance on “telling the story” by encouraging or requiring some form of “management discussion and analysis” (MD&A). Public companies use MD&A, as do governmental entities. In the end, the research project was terminated and the standards project resulted in the exposure draft to be released in April.

The objectives of the standards project include:

- Refreshing the financial reporting model

- Addressing disclosure volume/ineffectiveness (disclosure overload)

- Making simplifications where possible

- Focusing on net asset classifications, liquidity, financial performance, and cash flows

Under the current model, there is a lot of different information in the statement of activity. For example, “support and revenue” includes some that is available for operations, some that must be held until time restrictions expire, some that must be held until purpose restrictions are met, and some that may never be spent. It’s a hodgepodge, and all the various aspects and complexity of this information make it difficult for many non-accountant users to understand it. Further, while liquidity may be fairly discernable in the financial statements of business enterprises, for not-for-profit entities it must be divined by careful analysis and correlation of not only liquidity of assets and liabilities, but also the timing of call or use of net assets. That also is not a simple task for many users.

What if:

- Not-for-profit organizations could present a simple statement of activities with just one column reflecting the current-period operations, based on availability and connection to mission?

- A second statement (or component of one) contained all the inflows and outflows that are for future periods and purposes, or not available for current-period operations?

- The statement of activities showed both external resources and internal allocations by management (the board) that reflect how operations are managed (similar to management or budgetary reporting), to show how results compare with planned use of resources and management’s responses to change? The statement of cash flows made more sense and there was more correlation between it and the statement of activities?

- Notes to the financial statements were streamlined, with fewer disclosures, less reiteration of accounting standards, and more information to aid in understanding the way standards and options have been interpreted and applied?

This is what the proposed changes are intended to accomplish. Below, we provide a summary of the proposed changes with the goal of communicating the concept behind each. We encourage you to carefully study the exposure draft to understand how it may affect your organization.

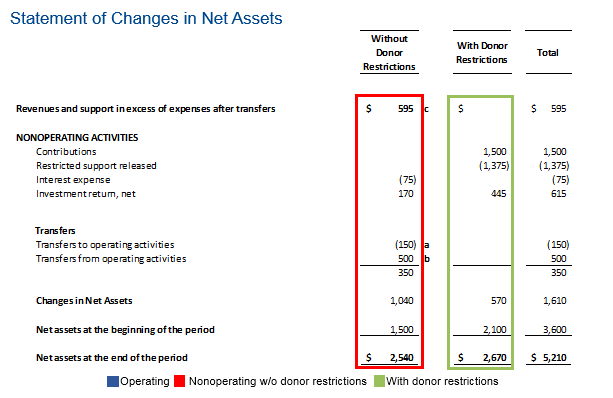

Overall Change – One major change in the update is to move from the rigidity of presenting three classes of net assets, to presenting net assets with and without donor restrictions. Note that the characteristics of donor restrictions (time, purpose, and perpetuity) will remain an important part of reporting and disclosures.

Statement of Financial Position – No significant changes are anticipated, other than conformity with presenting net assets with and without donor restrictions and encouraging better disclosure of the liquidity of those net assets.

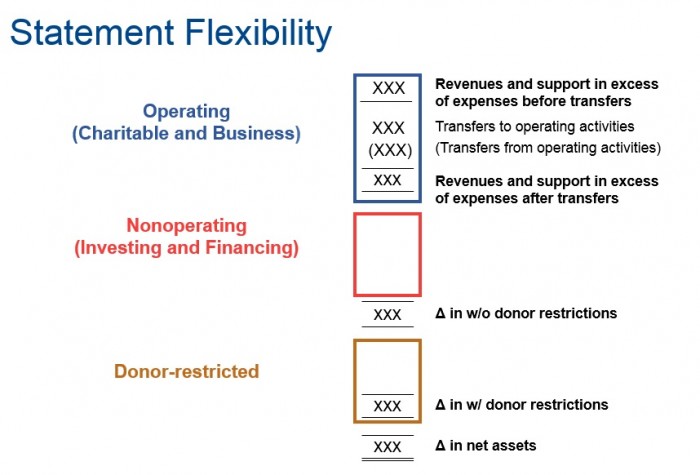

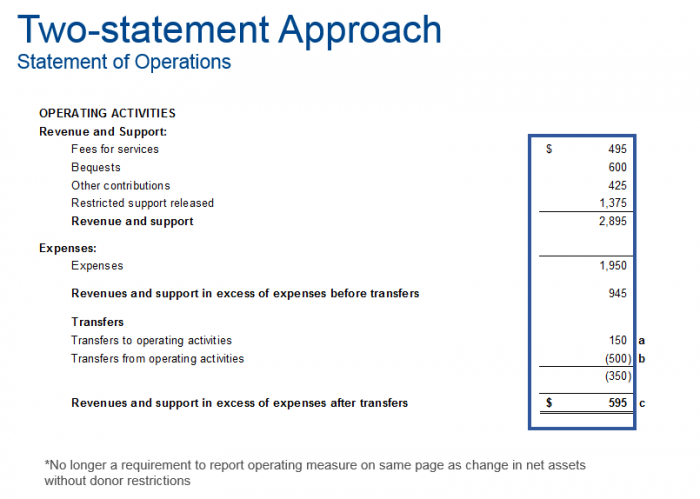

Statement of Activities – Allowing either a one- or two-statement approach, the most significant change will be focusing on operations. The dimensions of mission and availability will drive what is presented as operating and non-operating. Note that:

- Mission (Business & Charitable Activity) is based on whether resources are from or directed at carrying out the not-for-profit’s purposes for existence (vs. investing and financing).

- Availability is based on whether the resources are available for current-period activities, reflecting both a) external donor-imposed limitations, and b) internal actions of the not-for-profit’s governing board.

- External and internal actions or limitations will be reported discretely. Remember that all resources with donor restriction not available for the current period are reported outside of operations.

- Internal actions will be presented separately as “transfers,” with required disclosures. Examples include allocation of resources into reserves or quasi-endowment funds and release of the same.

- All gifts will be considered to be related to the organization’s mission.

- Gifts with donor restrictions that limit their use or that are not used until future periods will be classified as non-operating in the period received.

- Investing and financing activities will not be considered mission-related unless programmatic, such as interest student loans or programmatic loans.

- Capital-like transactions will include gifts of long-lived assets without donor restrictions and the gift of cash restricted for the acquisition or construction of the same. This is an area to look at carefully!

- By placing a gift of a long-lived asset in service, rather than selling it, the entity will effectively make it unavailable for current operations (only as use over time).

- Placed in service becomes determinative for recognition.

- An unrestricted gift of a long-lived asset will be reported within operations and transferred out as placed in service (rather than being sold).

- Restricted gifts for acquisition or construction will be outside operations and reported as revenues that increase net assets with donor restrictions.

- Once an acquired or constructed asset is placed in service, the restriction will be released and reported simultaneously as an operating inflow (release of restriction) and a transfer out of current operations.

Because a picture is worth a thousand words, here are illustrations of this:

Statement of Cash Flows – Fasten your seat belts — under the proposed changes, the direct method will be required. This may make many of you cheer, as it is much more meaningful and provides a measure of correlation with the statement of activities.

In addition to requiring the direct method, certain items would be re-categorized to better align “operating” with the activities statement and operating measure:

- Donated property and equipment would be reported as operating.

- Contributions restricted for the purchase of property and equipment would be reported as operating.

- Purchases of property and equipment would be reported as operating.

- Cash received from interest and dividends would be reported as investing.

- Interest paid on long-term debt would be reported as financing.

Disclosure Changes – The following summarizes the proposed disclosure changes:

- Investment income reported net of expenses. Only costs internal to a not-for-profit, such as investment managers on staff, will be disclosed.

- Expenses will be reported on a natural basis as well as a functional basis.

- There will be an expanded disclosure about cost allocation approaches.

- Quantitative and qualitative aspects of liquidity and financial availability, including characteristics of net assets with donor restrictions, will be included.

- Endowments will be reported as net assets with donor restrictions. Therefore endowment funds would be “brought back together” as they were once reported and be more consistent with their investment reporting.

Your Job

We encourage you to carefully study and consider the exposure draft when it is released. The FASB will provide the opportunity to comment online, and we hope you will share your perspectives and feedback.

While we often resist change, give this some room to resonate. The proposed improvements will increase the relevance, understanding, and meaningfulness of your financial reporting.