Nonprofit Resources

Common Questions About Minister’s Taxation

Here are answers to some common questions about minister’s taxation to help bring clarity and make this filing season a more efficient and enjoyable one.

Who does the IRS consider to be a minister?

Before we get to the unique aspects of ministerial taxation, let’s first define a minister for tax purposes. The IRS has developed a definition of a minister for this purpose that can be found in IRS Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers.

As a threshold matter, an individual seeking classification as a minister must be “duly ordained, commissioned or licensed by a religious body constituting a church or church denomination.”

In addition, a minister should have the authority to:

- Conduct religious worship

- Perform sacerdotal functions

- Administer ordinances or sacraments according to the prescribed tenants and practices of a church or denomination

- Control, conduct, and maintain religious organizations that are under the authority of a religious body that is a church or denomination

Courts have also considered whether an individual is viewed as a spiritual leader by a church body.

Why is minister’s taxation unique?

First, ministers are deemed to be self-employed for Social Security tax and Medicare tax purposes, while being employees for all other purposes. Second, ministers’ wages are not subject to income tax or payroll tax withholding. Third, ministers are eligible for a housing allowance, which is not subject to income tax.

What does it mean to say that a minister is self-employed for Social Security tax and Medicare tax purposes?

There are two different systems under which individuals may be taxed for Social Security and Medicare purposes: (i) the Federal Insurance Contributions Act (FICA) and Medicare, and (ii) the Self-Employment Contributions Act (SECA). Regular employees, i.e., non-ministerial employees, fall under the FICA system. Ministers, however, fall under the SECA system, the same as other self-employed individuals.

Individuals subject to SECA tax pay tax on their income at a rate of 15.3%. This amount is equivalent to the combined employer and employee portions of the FICA and Medicare tax. It is reported on Schedule SE when the minister files his Form 1040 at the end of the year.

If an individual is a minister under the definition above, then the individual is covered under SECA rather than FICA. This is not a choice, but rather a requirement of the Tax Code and must be followed in its entirety.

Are ministers’ wages subject to income tax or payroll tax withholding?

Because a minister is deemed to be self-employed, he is responsible for paying quarterly estimated tax payments. As a result, a church is not required to make this income or SECA tax withholding. However, a minister can request that the church withhold on his behalf instead of paying estimated tax payments. This is done by making a voluntary withholding request on IRS Form W-4, using line (c) at step 4.

What is the minister’s housing allowance?

The minister’s housing allowance (MHA) is a component part of a minister’s compensation package, which is not subject to income tax under Internal Revenue Code (IRC) section 107. Note, however, that the MHA is subject to SECA tax for ministers who have not opted out of Social Security.

Only those who are ministers of the gospel are eligible to receive an MHA.

Who should designate the MHA?

The designation should be done in an official action of the employing church. Often this is done through resolution or official action of the governing board or at a congregational meeting.

When should the MHA be designated?

The MHA must be designated before any payments are made to the minister. If the church does not designate the MHA before it is paid, then the full amount of the payment must be included in the minister’s income that is subject to both income tax and self-employment tax. A late designation (i.e., made after the beginning of the year) is only applicable to payments made after adoption. The same rule applies to mid-year changes to the MHA.

How is the amount of the MHA that is excludable from income tax determined?

The portion of the MHA that is excludable from the minister’s taxable income is the lesser of:

- The official amount designated as an MHA by official action of the church

- The fair rental value of the home, including furnishings, utilities, garage, etc.

- Actual housing expenses for the current year (including mortgage payment, property taxes, utilities, and furnishings)

The fair rental value of the home is generally determined by consulting a local real estate agent periodically.

The excess of the designated amount over the smaller of the fair rental value or actual housing expenses must be reported as other taxable income on Form 1040.

What is the self-employment tax treatment of the MHA?

The full amount of the designated MHA is subject to self-employment tax.

Should ministers receive a Form W-2 or Form 1099-NEC?

Even though a minister is deemed to be self-employed for Social Security tax purposes, in almost all cases a minister is considered an employee and should receive a Form W-2. This is because in the majority of cases, a church retains the legal right to control what a minister does and how he does it. Further, this is generally a desirable status because it has a direct impact on the tax-free treatment of many fringe benefits.1 Therefore, it is important that the church document the minister’s employee status and treat him as an employee.

A Form 1099-NEC is the correct form to use when a minister is an independent contractor and not an employee.

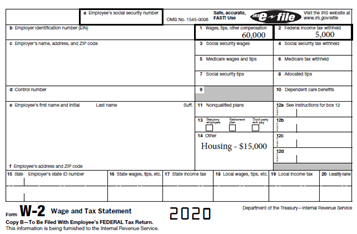

What should a minister’s Form W-2 look like?

A minister’s salary, exclusive of the MHA, should appear in Form W-2, Box 1. Any amounts voluntarily withheld by the church at the minister’s request should appear in Box 2. As mentioned above, a minister falls under the SECA system, which means that the church does not withhold any Medicare or Social Security tax. Therefore, Form W-2, Boxes 3 through 6 should be left blank. If you receive a Form W-2 as a minister and there are amounts in these boxes, your payroll has likely not been handled correctly as described in this article.

The amount designated as a housing allowance is often included in Form W-2, Box 14 for information purposes only, as shown below. This is not included in Box 1 as it is not subject to income tax.

Can ministers opt out of self-employment tax?

Ministers can request an exemption from self-employment tax by filing Form 4361, Application for Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners.2 This exemption is available to ministers who can certify that they are conscientiously opposed to, or because their religious principles are opposed to, the acceptance of any public insurance that makes payments in the event of death, disability, old age, or retirement; or that makes payments toward the cost of, or provides services for, medical care (i.e., Social Security or Medicare). This exemption only applies to income subject to self-employment tax.

It is important to note that this exemption is irrevocable and only applies to ministerial wages. Other wages received for non-ministerial services are still subject to the Medicare and Social Security tax. Requesting this exemption should not be done hastily or without making alternative plans for income during retirement.

Conclusion

Being a minister of the gospel is an amazing God-given responsibility, and, sadly, ministers can be easily weighed down by numerous non-ministerial tasks, including tax compliance. Hopefully, this brief overview has helped to bring clarity to some of the issues regarding ministerial taxation to assist with this tax season as well as future tax planning.

Please contact us with any questions.

1Michael Martin, Ministers Tax and Financial Guide, (Winchester: Evangelical Council for Financial Accountability, 2021), pg. 17.

2IRS Publication 517, pg. 6.

Sara Tibbott

Sara is a Tax Manager serving nonprofit clients in the firm's North region in all areas of tax compliance and consulting. Prior to joining CapinCrouse in 2015, she served as a senior at BlumShapiro. Sara has more than 15 years of experience providing tax compliance services to nonprofits, corporations, partnerships, and high-net-worth individuals, including estate tax planning and trust compliance. She also has experience with review and compilation work for various companies.