Nonprofit Resources

Reconciling Liquidity to Net Assets without Donor Restrictions, an Addendum

While one of the goals of this ASU is to improve information in nonprofit financial statements and notes about liquidity and availability, we continue to receive questions from church management, boards, and other financial statement users about how the “Net assets without donor restrictions – undesignated” amount compares to “Financial assets available to meet cash needs for general expenditures within one year” total. This addendum focuses on that specific question and provides an additional analysis that may be used to explain this difference with management, boards, and others.

Reconciling Liquidity to Net Assets Without Donor Restrictions

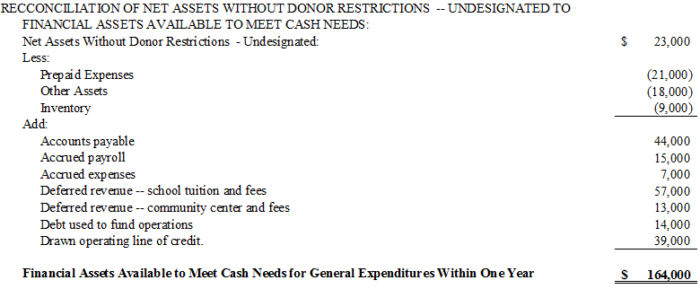

In Liquidity & Availability Disclosure Considerations for Churches in ASU 2016-14, we provided the reconciliation in Figure 1 as a tool to help explain that difference. Figure 1 shows the reconciliation in that article:

Figure 1

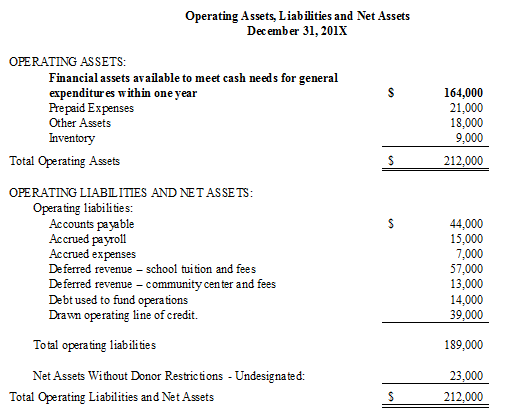

Some individuals continue to have questions about the reconciliation presented in Figure 1. So Figure 2 provides a different approach using the same information as Figure 1, but presented in Balance Sheet statement format. If you separate out just the operating component of assets, liabilities, and net assets, it becomes much simpler.

The statement of operating assets, liabilities, and net assets below may be used to further present these amounts and their differences. (Note: This statement is not intended to be included in the external financial statements or related footnotes, but rather function as a management tool to assist users in understanding the difference between the two amounts.)

Figure 2

Again, we emphasize that your church should not use the new disclosure amount to measure operating reserves. One tool that can be very useful to management and the board in monitoring these reserves is the CapinCrouse Church Financial Health Index, an online dashboard with key measures, ratios, benchmarks, and peer information. Many churches use this tool with their church boards to monitor cash reserve levels.

If your church hasn’t considered how the liquidity disclosures will look in the footnotes, do it soon so you have time to consider the factors discussed in Part 1 and Part 2 before the end of the fiscal year. This is especially important for churches with a December 31, 2018, fiscal year-end.

Richard Lindley

Richard has managed audit, review, and compilation engagements for more than 20 years and provides church and other nonprofit consulting services in a variety of areas. He is a member of the firm’s Church and Denominational Team and helped draft the CapinCrouse Church Financial Health Index™ and CapinCrouse Church Checkup™ and related reports. Richard frequently authors church articles. He also serves as his church’s finance ministry leader.

Comments are closed here.