Nonprofit Resources

Adopting CECL: What Nonprofits Need to Know

What is CECL?

CECL is the acronym for current expected credit losses, the overarching concept of the new Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC). Prior guidance was based on the incurred loss model, which delayed recognition of credit losses until it was probable the loss had been incurred. CECL requires organizations to estimate loss risk over the expected life of the financial asset and not just when the risk of loss is “probable.”

CECL was first introduced in FASB Accounting Standards Update (ASU) 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. It is effective for all nonprofits for fiscal years beginning after December 15, 2022. This means that it is effective for calendar years ending December 31, 2023, and fiscal years ending in 2024.

Does CECL apply to my nonprofit?

CECL applies if you have any assets within the scope of the standard. Broadly, the scope of CECL includes accounts receivable and loans receivable balances. (Other financial instruments are included, as described in FASB ASC 326-20-15-2, but accounts receivable and loans receivable are the most common transaction classes applicable to nonprofits.)

It’s important to note that pledge receivable balances are not included in the scope of CECL.

What is the largest shift in methodology? How will that impact my reserve calculation?

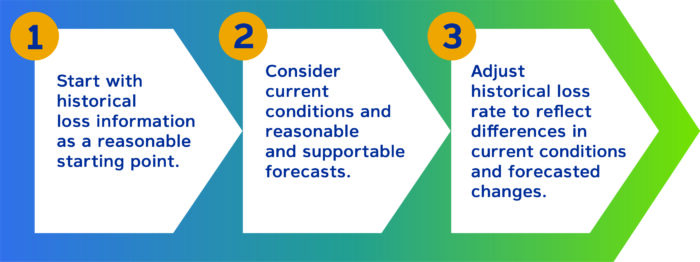

To estimate loss risk over the expected life of the financial asset, CECL requires organizations to consider past events, current conditions, and reasonable and supportable forecasts.

To estimate the risk of loss, consider your historical experience with the same type of receivables as a starting point. Next, consider how conditions today differ from those of the past and what the future looks like, then adjust the historical loss rate to reflect those differences.

Do I need to use an entirely new method to calculate the reserve?

You can continue to use your existing methodology, such as analyzing historical loss rates based on aging schedules, as a starting point for your reserve calculation.

One change is that CECL requires organizations to pool assets with similar risk characteristics for reserve calculations. Any assets that do not share similar risk characteristics should be evaluated individually.

As an example, let’s consider a university with a significant amount of traditional student accounts receivable as well as accounts receivable from churches that use the university’s facilities for retreats. The university determines that the students and churches have different risk characteristics and places its accounts receivable into two pools for evaluation purposes.

How do I calculate reasonable and supportable forecasts?

To calculate reasonable and supportable forecasts for your organization:

- Determine what future conditions would affect the risk of loss for each pool of receivables

- Evaluate what reasonably reliable forecast information is readily available

- Determine how far into the future you can reliably forecast

- Once you are unable to make reasonable and supportable forecasts, revert to historical loss information

As a general concept, most organizations forecast for up to two years. For accounts receivable due in less than a year, you likely will not revert to the historical loss period.

When determining a reasonable and supportable forecast, you do not need to consider all available sources of information. Instead, consider reasonably available and relevant information you can obtain without undue cost and effort. This can include internal information, external information, or a combination. For example, if your investment manager provides economic outlook information, you may determine that it is appropriate to include this information as a basis for your forecast.

What are the financial statement implications of CECL? What disclosures are required?

The disclosures should enable a reader of your financial statements to understand:

- The credit risk inherent in the portfolio and how management monitors it

- Management’s estimate of expected credit losses

- Changes in the estimate that have taken place during the period

Each organization should consider how much detail is needed to meet the objective of the standard based on its specific facts and circumstances. If you provide too much aggregation, important details may be missed. However, if you provide too much disaggregation and detail, material information could be obscured.

The required disclosures include:

- A description of management’s policy and methodology for developing the allowance for credit losses

- A roll-forward of changes in the allowance

- Transition disclosures in the year of adoption

- An aging analysis of past-due loans*

- Credit quality indicators*

If a balance is relatively immaterial to the overall financial statements, you may consider providing the disclosures above in narrative form rather than a longer tabular format.

The allowance must be presented on the face of the statement of financial position as:**

- A separate line item from the corresponding receivable balance; or

- Asset shown net of receivable, but with the amount disclosed in a parenthetical reference.

What information should I include in my organization’s CECL documentation?

Your nonprofit’s CECL documentation should include:

- The pools you will use to evaluate expected credit losses and how you determined those pools (ASC 326-20-30-8)

- Your reason for evaluating a receivable on an individual basis rather than with its respective pool

- What historical period of losses you will include in your analysis

- How current conditions differ from those of the historical period you used

- What future forecasts impact the collectability of your financial assets

- What period you can reasonably forecast and when you will revert to historical losses

It’s important to understand which of your nonprofit’s assets may be within the scope of the standard and begin planning for the impact on your financial reporting. Please contact us with any questions or if you would like to discuss how we can help your organization implement this new standard.

*Disclosure not required for accounts receivable due in less than one year.

**Materiality can be considered for this requirement as well.

Lisa Wabby

Lisa joined CapinCrouse in July 2006 and serves as a partner. She has acquired a broad range of experience through serving a variety of clients within the nonprofit industry, including churches, colleges and universities, loan funds, foundations, international mission organizations, and voluntary health and welfare organizations. In addition to providing audit, accounting, and consulting services, Lisa is a member of the firm's Quality Control team. In this role, Lisa is an integral part of developing content for continuing professional education, developing strategies to implement new audit and accounting standards, and providing technical assistance to team members across the firm.